The Hulbert Bond Newsletter Sentiment Index (HBNSI) reflects the average recommended exposure to the U.S. bond market among a subset of short-term bond timers.

Though the list of market timers incorporated in the HBNSI is proprietary, included are all bond market timers tracked by the Hulbert Financial Digest who (a) have the ability to communicate immediately to clients whenever they change their recommended bond market exposure and (b) for whom the recommended exposure level when bullish is at least 50 percentage points higher than when bearish.

The HBNSI is updated every day the NYSE is open, approximately one hour after the close of trading. You may subscribe to either daily or weekly updates of the HBNSI. Click here for more information.

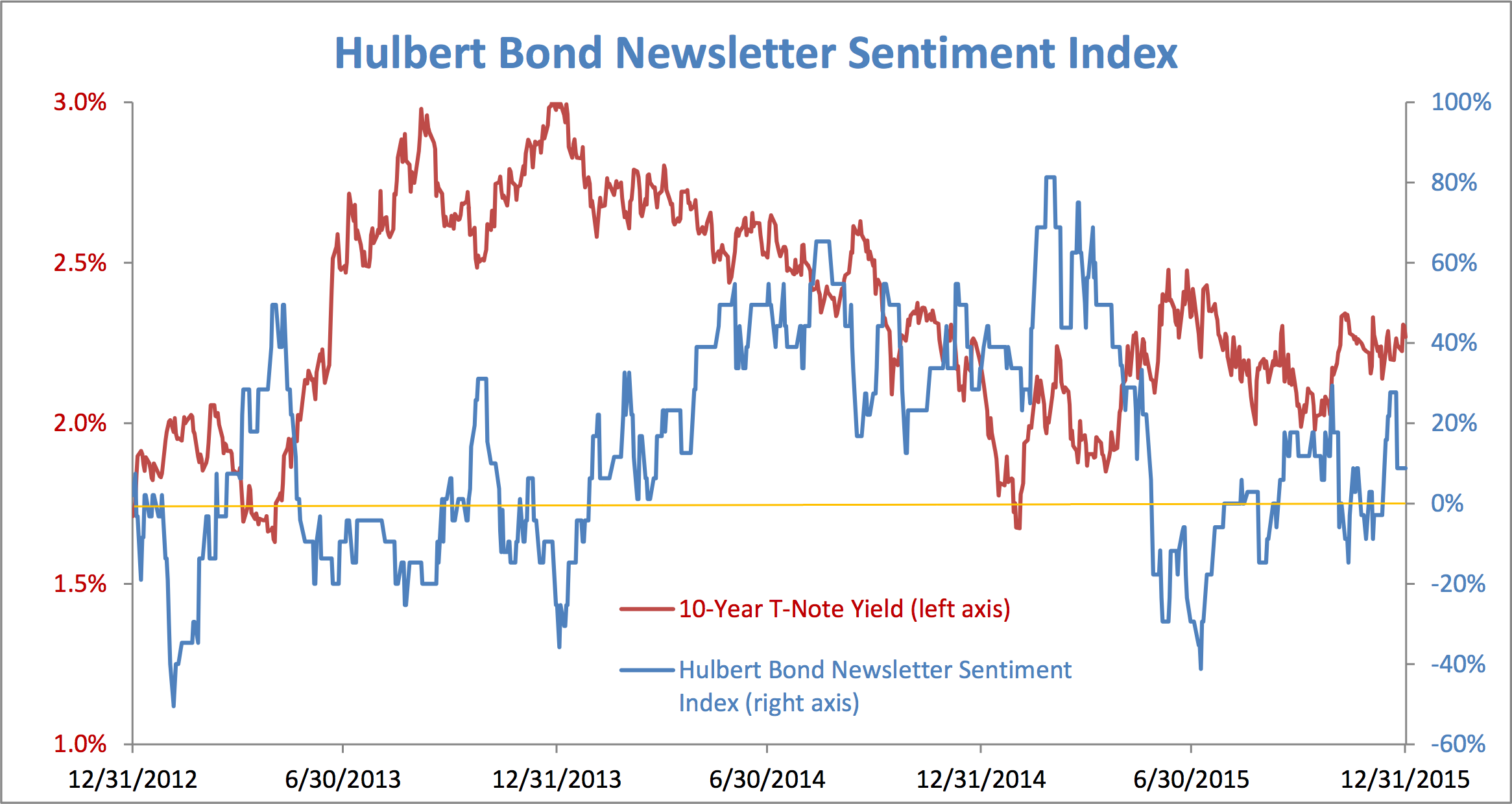

The HBNSI historically has been inversely correlated with the bond market’s subsequent short-term trend. (Because bond returns are themselves inversely correlated with their yields, this means the HBNSI is positively correlated with bond yields; see accompanying chart.) Econometric tests of the HBNSI back to 1985 show that its maximum predictive power exists at the one- to three-month horizon.